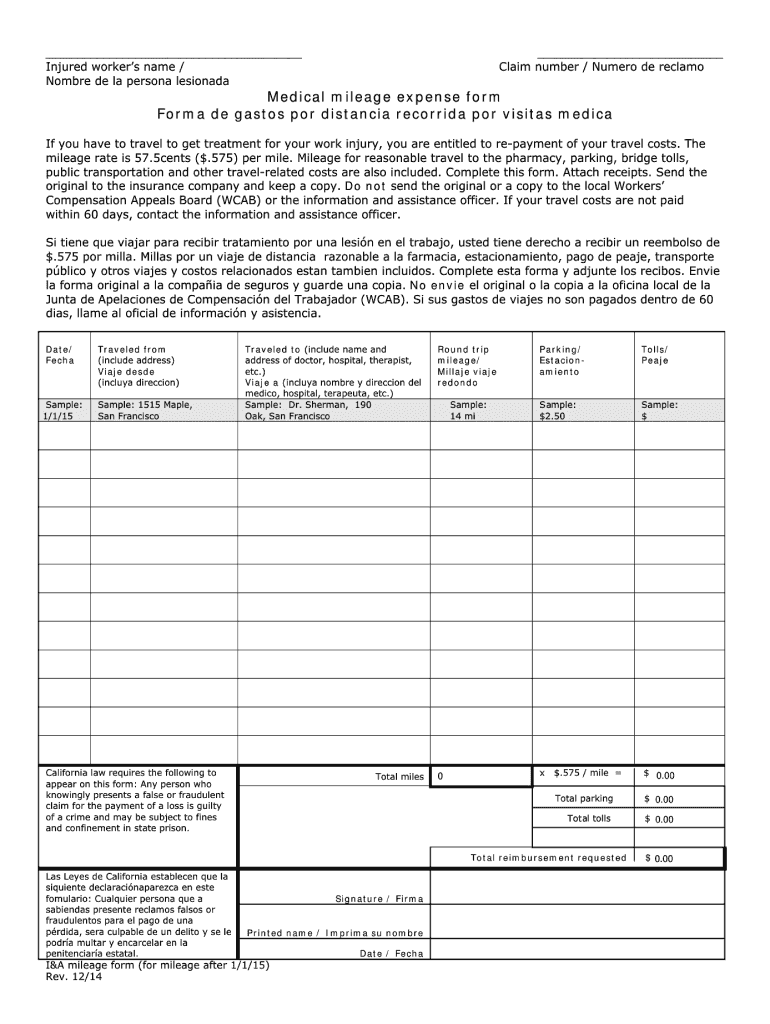

Tax Mileage Rate 2025 - Calculate gas mileage reimbursement AmandaMeyah, In addition, the notice provides the maximum fair market value of employer. The irs has just released the updated standard mileage rates for 2025, which are crucial for calculating deductible expenses associated with. IRS Mileage Rate for 2023 What Can Businesses Expect For The, For tax year 2023 (the taxes you file in 2025), the irs standard mileage rate is 65.5 cents per mile when used for business. The standard business mileage rate.

Calculate gas mileage reimbursement AmandaMeyah, In addition, the notice provides the maximum fair market value of employer. The irs has just released the updated standard mileage rates for 2025, which are crucial for calculating deductible expenses associated with.

For tax year 2023 (the taxes you file in 2025), the irs standard mileage rate is 65.5 cents per mile when used for business.

It applies to a variety of incomes. Irs mileage rates for 2023.

Mileage Form 2025 IRS Mileage Rate 2025, 2025 standard mileage rates announced by the irsmileage rates for travel are now set for 2025. Travel — mileage and fuel rates and allowances.

Tax rates for the 2025 year of assessment Just One Lap, The irs is raising the standard mileage rate by 1.5 cents per mile for 2025. 2025 standard mileage rates announced by the irsmileage rates for travel are now set for 2025.

Ny Form Ud 1 Fillable Pdf Printable Forms Free Online, The new rate kicks in beginning jan. In 2025, you drive 3,000 miles for various business meetings.

Federal Mileage Rate 2023 Know More About IRS!, In addition, the notice provides the maximum fair market value of employer. Here's how to maximise income tax savings from employees' provident.

Free Mileage Log Templates Smartsheet, The 2025 irs mileage rates have been set at 67 cents per mile to accommodate the economic changes over the past year. This represents a 1.5 cent increase from the 2023.

The Only HR Solution Just for Churches & Ministries — Q. "What is the, 14 cents per mile for charity. In addition, the notice provides the maximum fair market value of employer.

70¢ per kilometre for the first 5,000 kilometres driven.

Standard Mileage Rate 2025 Ambur Marianna, Standard mileage rates for 2025. The irs has just released the updated standard mileage rates for 2025, which are crucial for calculating deductible expenses associated with.